Add stability and predictability to your RV Park business by locking a portion of your real estate financing into a long-term, fixed-rate product using an SBA 504 loan.

A 504 loan has three components:

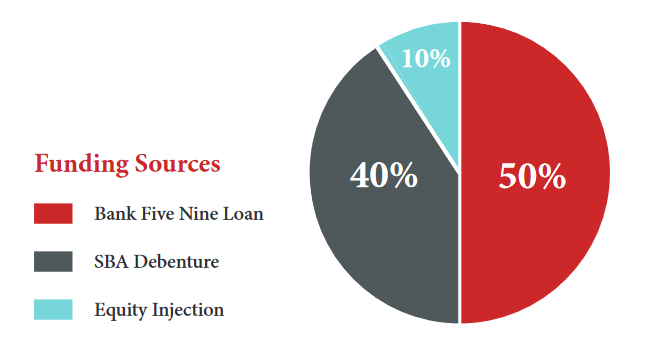

- Equity injection provided by the borrower – typically 10% of the project but can be 15% – 20% in certain instances as in the case of start-ups or unique situations

- Term loan provided by Bank Five Nine – typically 50% of the project

- Debenture loan provided by a Certified Development Company (CDC) – typically 40% of the project*

SBA 504 loans fund a variety of business needs including:

- Purchase, renovate or expand an existing property

- Construct a new facility

- Refinance existing debt

Nick Collins

VP, Business Development Officer – SBA Specialist

(262) 560-2016 | nick.collins@bankfivenine.com