Why This Industry Matters Right Now

Camping and RV travel have evolved from niche pastimes into one of the most dynamic corners of the outdoor hospitality sector. What was once defined by rustic campsites and seasonal RV parks now encompasses everything from family-owned campgrounds to luxury glamping resorts with curated experiences. But its appeal goes far beyond affordability and flexibility. For millions of Americans, camping provides a restorative escape – an opportunity to reconnect with nature, unplug from digital overload, and prioritize mental well-being. As travelers seek more meaningful, health-conscious ways to recharge, the RV park and campground industry has emerged as a powerful response to this cultural and lifestyle shift. To understand the momentum behind this movement, it’s essential to first explore the true size and structure of the market.

What Counts as the RV Park & Campground Industry?

A Quick Primer on Definitions

The RV & campground industry includes:

- Privately owned RV park: Independently owned and operated parks, sometimes affiliated with large networks like Kampgrounds of America (KOA). These parks typically offer a mix of RV sites with full hookups (electric, water, and sewer) and basic amenities, such as restrooms, laundry facilities, and recreation areas.

- Public and state-run campgrounds: Campgrounds owned by federal, state, or local agencies (i.e., U.S. National Park Service, state parks, county parks). They prioritize public recreation and conservation over profit.

- Glamping resorts and hybrid models: “Glamorous camping” resorts that merge traditional camping with luxury hospitality. Hybrid models may offer both upscale glamping and standard RV/tent sites.

- Campgrounds with cabins, tiny homes, or yurts: Campgrounds that expand beyond RV and tent sites to include alternative lodging options such as rustic, cabins, tiny homes, or yurts, appealing to non-RV travelers.

- Mobile home or RV resort communities with long-term leases: Planned communities or resorts that cater to seasonal residents, retirees, or long-term RV owners. Guests typically lease sites for extended stays, sometimes on annual or multi-year agreements.

How big is the RV Park & Campground industry?

The outdoor hospitality sector, which includes RV parks, campgrounds, and the rapidly growing glamping segment, is now a major player in U.S. recreation. The RV park and campground industry alone comprises more than 16,200 privately owned parks with 1.3 million campsites (RVParkIQ), as well as an estimated 13,000 public campgrounds managed by agencies such as the National Park Service and the Bureau of Land Management. Altogether, the sector is valued at nearly $10.9 billion in 2025 (IBISWorld).

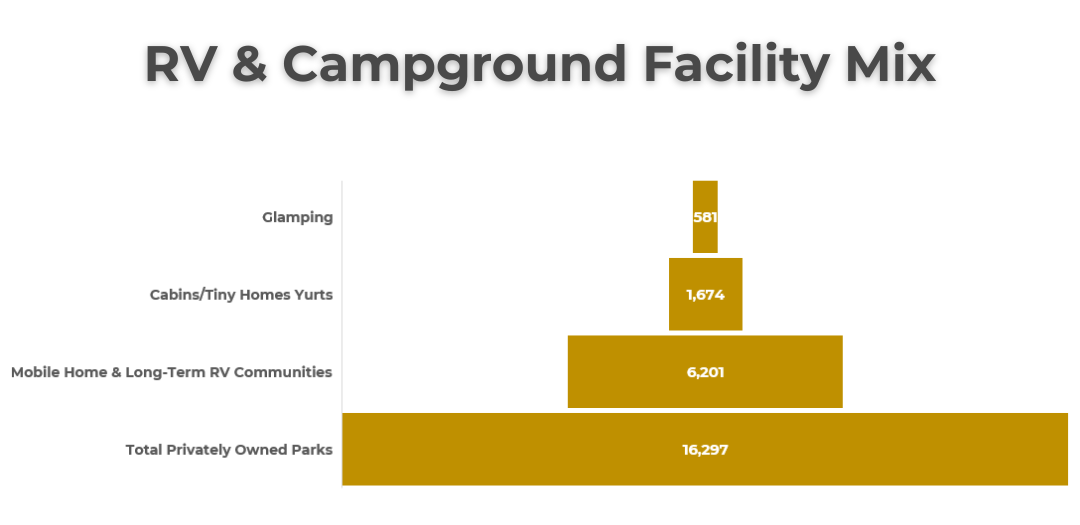

What type of alternative lodging do RV parks and campgrounds offer?

Beyond traditional RV sites, the industry is diversifying fast. Out of the 16,200+ privately owned parks tracked by RVParkIQ, about 581 (3.6%) now offer glamping options, while another 1,674 (10.3%) include cabins, tiny homes, or yurts to attract non-RV travelers. On the residential side, roughly 6,201 parks (38%) operate as mobile home or long-term RV resort communities, showing how the sector blends both short-term stays and extended outdoor living.

Where are RV parks & campgrounds located in the U.S.?

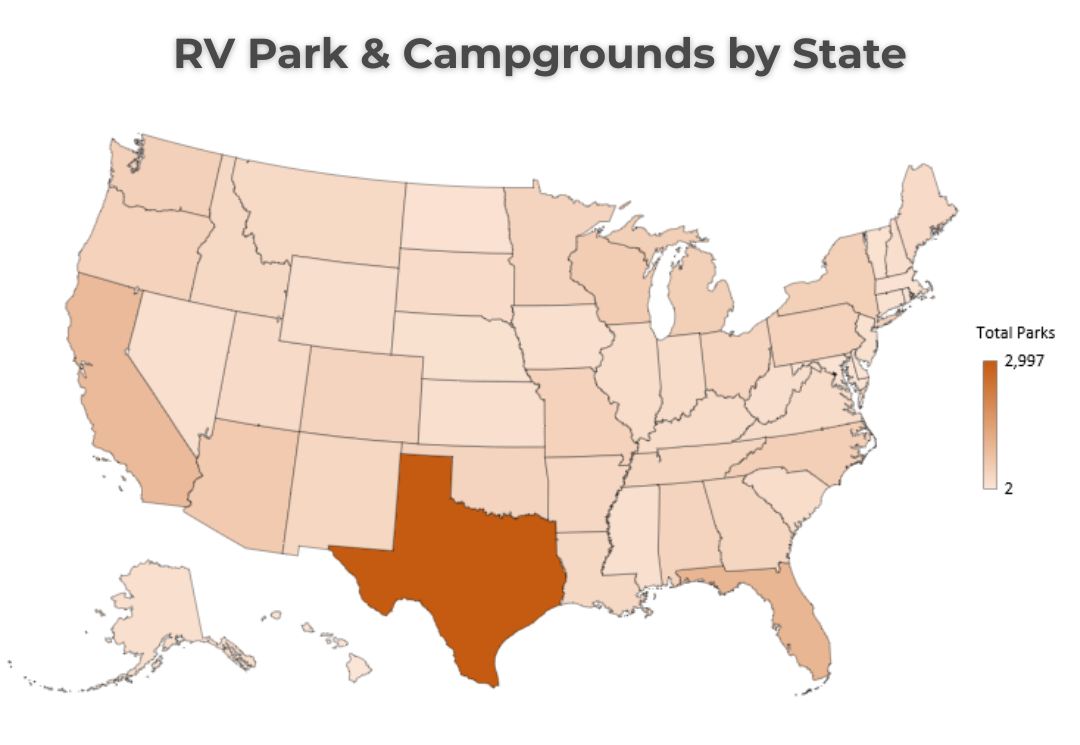

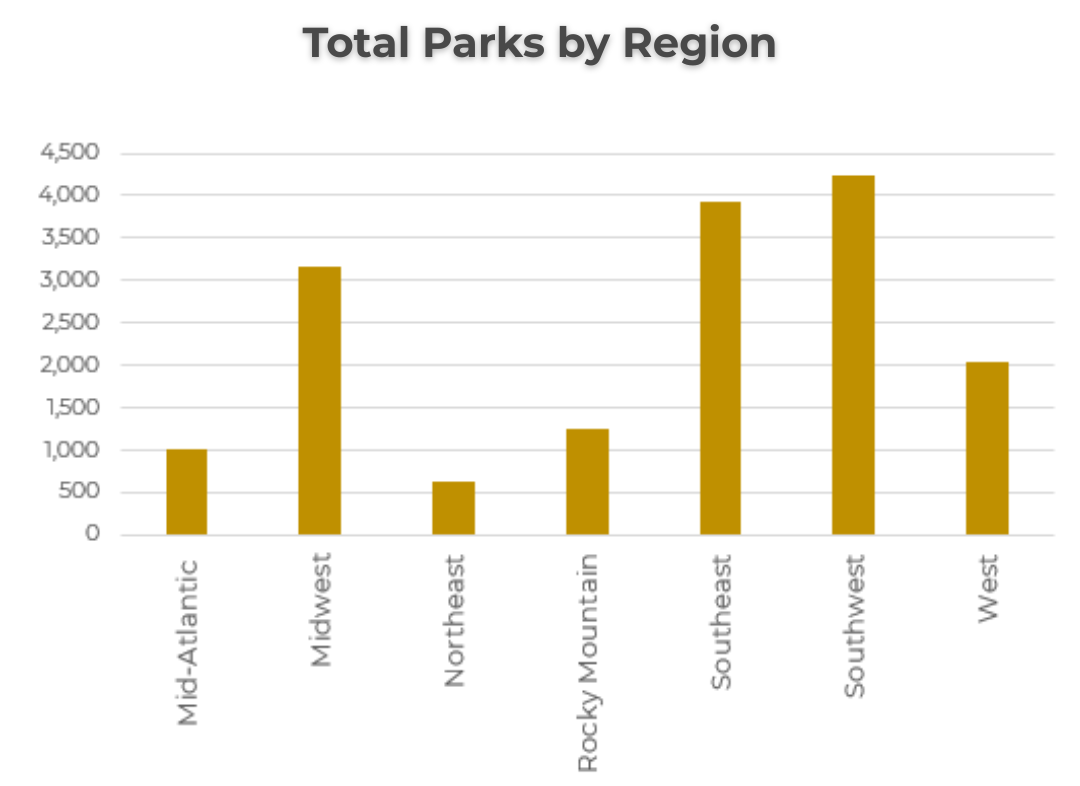

Geographically, RV parks and campgrounds are concentrated in a few key regions. Approximately 50% of all facilities are located in the South, with an additional 20% in the Midwest. The Northeast accounts for only 4%, while the Rocky Mountain region represents another 8%. At the state level, Texas leads with nearly 3,000 parks, followed by Florida with over 1,000, and California, close behind, with 919. This distribution highlights how the industry clusters around warmer climates and tourism-driven destinations, shaping where demand and investment opportunities may be strongest.

Who owns RV parks and campgrounds?

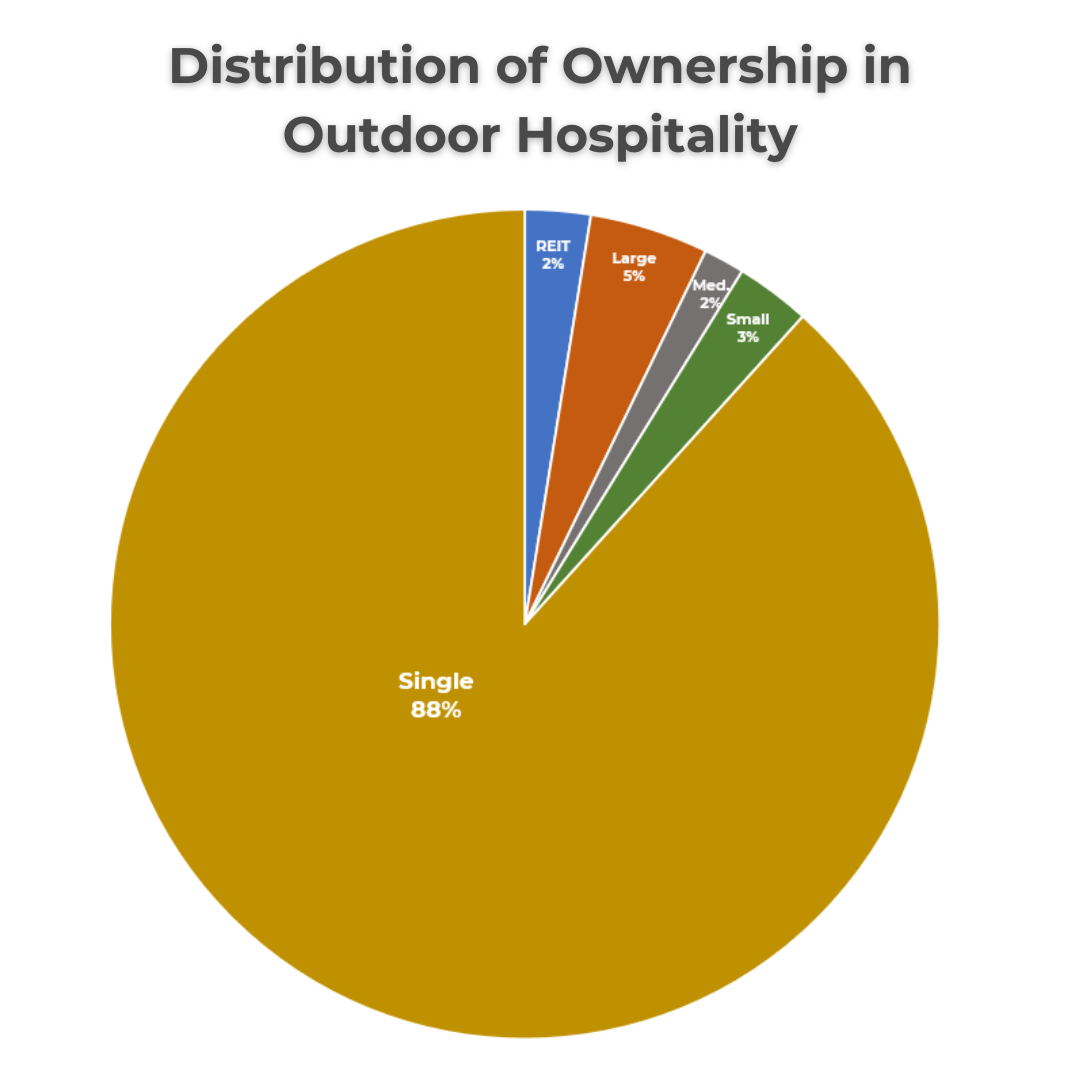

When it comes to ownership of these parks, the industry is still highly fragmented. Nearly 88% of facilities are independently owned, while REITs account for just 2% of the market. Larger operators with more than 20 facilities represent about 5%, and another 5% is held by small- to medium-sized platforms. This breakdown highlights the entrepreneurial roots of the industry and the growing role of institutional players looking to scale.

How Many People Go Camping and RVing?

Camping participation has surged in recent years. KOA reports that 58 million households camped between 2020-2023, and by 2024, 11 million more households were camping compared to 2019. That demand translated into $61 billion in camping expenditures in 2024, underscoring the sector’s role as a major driver of the travel economy. RVing remains central to this growth, with nearly 15 million households camping in RVs at its 2022 peak and about 10 million doing so in 2024. RV travel remains at the core of this momentum, drawing nearly 15 million households in 2022 and still engaging about 10 million in 2024.

The demographic base of campers is shifting as younger generations take the lead. Millennials now comprise 31% of all campers, with Gen Z close behind at 26%, indicating a strong pipeline of future demand. According to the RV Industry Association (RVIA), today’s RV owners are younger, more representative of the broader population, and using their RVs more often – a median of 30 days per year, up 50% since 2021. With 8.1 million households currently owning an RV and another 16.9 million considering a purchase within five years, the outlook for growth remains robust.

What’s Fueling the Growth of This Industry?

Demand-Side Drivers

- Record RV Ownership: RVIA reports 8.1 million U.S. households own an RV

- Remote Work Culture: Full-time RV living and hybrid travel/work lifestyles on the rise

- Affordability vs. Hotels: RV stays often cost less than hotels, especially for families

- Public Land Access: 640M+ acres of public land sustain long-term demand

- Generational Shift: Millennials (31%) and Gen Z (26%) now drive most camping activity

Supply-Side Trends

- Increased Private Equity Investment: Firms like Blackstone and Sun Communities are expanding portfolios

- Big-Name Entry: Hotel giants such as Hyatt, Hilton, Marriott, and BWH Hotels are venturing into outdoor hospitality

- Continued development: New parks and expansions keep rising despite zoning challenges

- Amenity-Driven Differentiation: Wi-Fi, pools, playgrounds, and community events are becoming standard

- Glamping Growth: Luxury tents, yurts, and tiny homes broaden the market beyond RV users

TL; DR: How Big Is the RV Park & Campground Industry?

- Scale: Over 16,200 privately owned RV parks with 1.3M+ campsites, plus 1,500 public campgrounds; industry valued at $10.9 billion in 2025.

- Participation: 58 million households camped 2020–2023, with 11 million more camping in 2024 vs. 2019; Millennials (31%) and Gen Z (26%) now lead participation.

- Economic Impact: $61 billion in camping expenditures (2024), fueling local tourism and rural economies.

- Facility Types: 3.6% offer glamping, 10.3% feature cabins/tiny homes/yurts, and 38% are long-term lease communities.

- Geography: Half of all parks are in the South; top states are Texas (~3,000+ parks), Florida (1,000+), and California (919).

- Ownership: Still fragmented with 88% independently owned, just 2% REITs, and 10% multi-facility owners, leaving room for consolidation.